Covered Calls:

Using Stock You Own to Generate Cash Flow

Americans are bullish! We believe the markets will always go up, and if we invest long enough our accounts will grow, and we’ll make money.

Most people are what we call buy & hold investors. They “buy” a stock, and then are content to just “hold” it to watch the profits materialize as the stock invariably rises over time. Of course it’s going to rise…that’s why we bought it!

How high will it rise? To quote the great Ralph Kramden…”To the moon Alice!”

But what if it doesn’t rise? Most investors are willing to hold, as long as they don’t lose, and many others will hold even if they’re losing. How many financial advisors advise folks to sell stocks, at any point, or to just hold…it’ll come back?

Just like many people use an asset, like their house, to take home equity loans, to generate cash from the asset…we can do the same thing with a stock we’re holding.

We can use the asset, the stock, to generate monthly, or even weekly, cash flow against the value of that asset…by selling call options.

It’s really simple, in concept. When selling call options, we’re taking on an obligation to sell shares of stock, in exchange for collecting a premium. We would sell a call option, at a specific “strike” price, and collect the premium. If the stock rises above that strike price by the options expiration date, we’d be obligated to sell the shares. But we got paid to sell our shares!

However, if the stock stays below the strike price by the expiration date, we don’t have to sell our stock…and we get to keep the premium collected!

And then guess what…we could do it again the next week, or the next month. As long as we own the stock, we can continue to sell calls against the position on a regular basis, and generate consistent cash flow. (Of course, as long as you hold the shares, you’re at risk of the stock dropping, and losing more on the stock position, than you collected from selling the calls).

So, yes, you might have to sell your stock, but you got paid to do so. You literally would have gotten paid to sell your shares, for a greater profit, than just selling the shares at a specific sale price.

For example purposes:

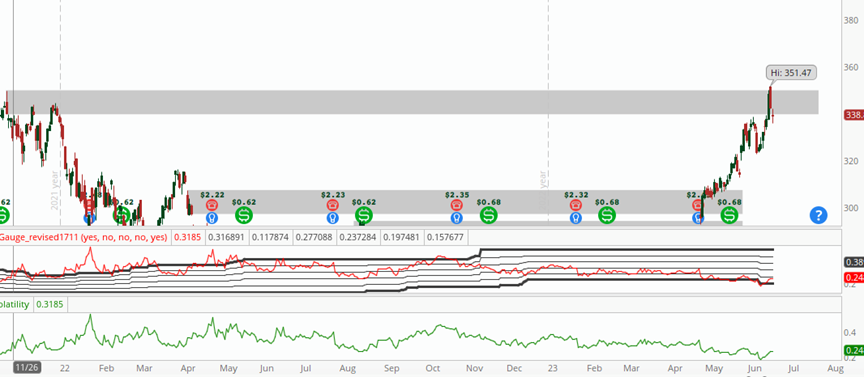

MSFT is trading at $340/share this morning. If you thought MSFT wouldn’t get to $345 in ten days, (the middle of the supply zone, or you’re just willing to sell your shares at $345), you could sell a MSFT Jun 30 345 call option, and collect $3.25 in premium.

As options represent the right to buy, or the obligation to sell shares in 100 share blocks, you’d need a minimum of 100 shares to sell one call option. Once you sell the call option, you’d collect $325, (minus commissions). The money is deposited into your account, and there’s nothing for you to do. If the stock gets above $345, you’ll sell your shares…but your effective sale price is $341.75.

And if the stock doesn’t get to $345, you keep your shares, and you keep the $325.

Then if you were so inclined, you could sell another call option, at another expiration date, and collect another premium.

So, to generate covered call revenue, you have to own the shares, in 100 share increments. And at any time the shares could tank, for any reason, resulting in a much larger loss than any covered call revenue collected. But that’s the risk you’re already taking on when owning stock.

Needless to say, there’s more to the process than discussed above. You need to understand how options work, how option premium decays, which strike price to sell and which expiration date to choose.

Remember there are no guarantees in the markets. If done properly, they can generate significant additional profits over time. However, if done incorrectly, it can add to losses on the stock holding.

Good luck!